Jan 31st 2014, 14:51, by Ingrid Lunden,Pankaj Mishra

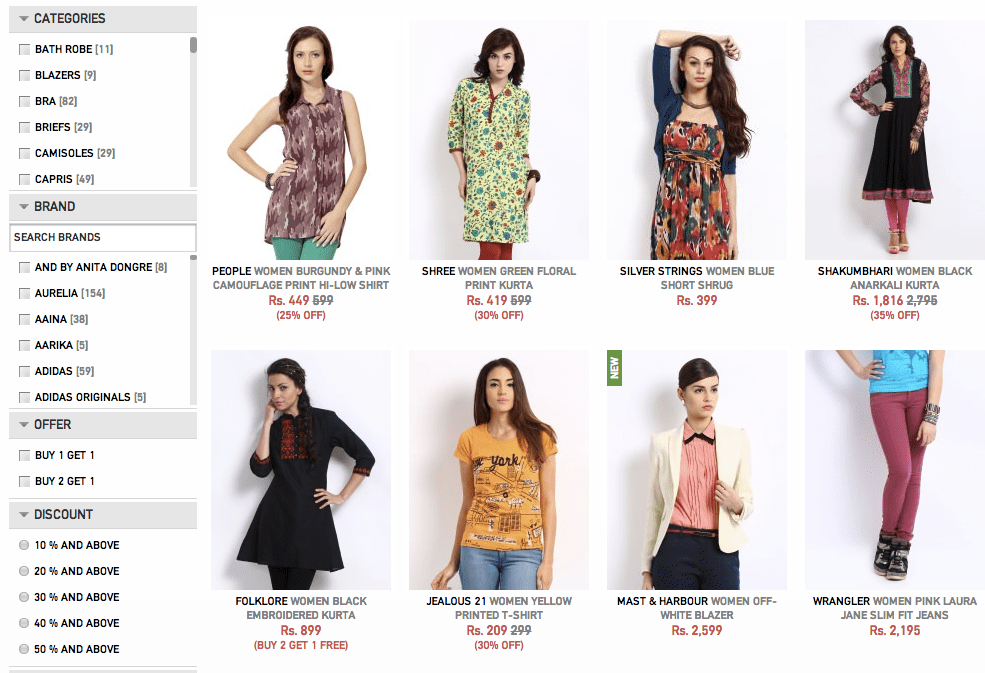

India’s e-commerce market is projected to grow sevenfold to $22 billion in the next five years, and investors and global e-commerce companies want to have a piece of the action. We have learned that Myntra, one of the bigger fashion portals in the country focusing both on traditional and more western fashion, has closed a $50 million round of funding. And, as that round closed, it got approached by both Amazon and Flipkart (known informally as “the Amazon of India”), with Flipkart making an acquisition offer in the region of $200 million.

The developments come on the heels of reports of both Flipkart’s interest and a fundraise.

The $50 million round, with a pre-money valuation of close to $200 million, has four main investors: PremjiInvest, Belgian-based Sofina, Accel and Tiger Global. A fifth, L Capital, may also be involved.

PremjiInvest is the investment vehicle of the family of Azim Premji, with a fund size of approximately $2 billion and a strong focus on tech. (Premji is the chairman of Wipro, the Indian IT giant that is surely one of the most epic pivots of all time: Wipro started as Western Indian Vegetable Products.) Sofina is a Belgium-based investor with a specialty in e-commerce, and both it and Tiger Global also invest in Flipkart, most recently in that company’s$160 million round. Accel is an active investor in India and was a previous investor in Myntra, which has now raised $125 million to date.

From what we understand, although the funding round and the names of the investors have been reported for some months already, it has now closed. An official announcement is due next week.

What the $50 million will mean is that Myntra now has the funds to continue to invest in its business for the next stage of growth as a standalone company, if it so chooses. The company is on track to have gross merchandise value — the total value of goods sold via Myntra’s portal — of $100 million for the current fiscal year. But it has been growing at a rapid rate. In April 2013 the rate was 100% every six months, and Myntra believes that GMV will be $1 billion by 2016-2017.

As a point of comparison, Flipkart is projecting a GMV of $1 billion by 2015.

The acquisition approaches, from what we understand, are being considered regardless of the fundraise and bigger strategy. We are still trying to get more information about the offer from Amazon. The Flipkart deal at $200 million, meanwhile, has been described to us as more of a “merger.”

“Interest from Flipkart validates the growth that Myntra is seeing,” one source very close to the negotiations told us. “[The] board is looking at all options but the fundraise is being closed in any case.”

As Pankaj noted the other day, India’s e-commerce market (sans travel sites) is currently worth $3.1 billion annually — just 1.5% of the value of China’s e-commerce sales, which are approaching $200 billion.

But as a huge country with a fast-growing middle class, India is seeing a relative boom in technology, which is playing out in mobile and internet penetration and expanding use of online services.

In other words, there is a world of opportunity for the future that larger, global players like Amazon and eBay (which has made a $50 million investment in another big e-commerce player in India, Snapdeal) want to capture. And so, while these two and others wait to see what India’s regulators decide to do with foreign investment rules for e-commerce, they are getting their ducks in a row.

As we have seen in other markets, e-commerce is a game of scale, where sales margins are low but volume is high, and logistics and back office investments make way more financial sense when rolled out across a larger footprint. Myntra consolidating with either another local player like Flipkart, or coming under the wing of a global giant like Amazon, would feed into that basic model.

But regardless of what happens higher up in the food chain, the same trend could also point to Myntra making some acquisitions of its own in the months ahead. It has made two acquisitions to date — interestingly, both in the U.S. In 2012, it acquired Exclusively.in, a private label site. And last year, it picked up Fitiquette, a Disrupt finalist that had developed virtual fitting room technology.

We are reaching out to Myntra, Flipkart, Amazon and investors for more details and will update the story as we learn more.

No comments:

Post a Comment