Raising capital from investors is often a frustrating experience. While part of that frustration will always be present when working on high-risk projects, a lot of the aggravation comes from the lack of clear signposts that allow founders to judge their company’s performance. The reality is, most founders only ever hear a “yes” or a “no” from a venture capitalist, without a lucid understanding of the factors that influenced that decision.

There have been fantastic essays written about the fundraising process itself, such as

Paul Graham’s guideposted last year. This post is not a guide to fundraising, but rather a look behind the curtain from my own experience as a venture investor at most of the quantitative metrics that are analyzed when judging an early-stage startup.

These metrics fall into five groups: financial, user, acquisition, sales, and marketing. While the statistics are important, the relevant weight any one metric will hold in a VC’s decision will depend on the type of startup, as well as the VC’s own opinion about which metrics matter and which do not.

When possible, I give guideposts on how to judge a particular value. These are from my own experience analyzing and engaging several hundred startups over the past two years, and all of my personal biases are certainly present. As with any guidelines in the venture business, companies break rules and expectations all the time.

Financial Metrics

Finances are crucial for any startup, and some companies are indeed funded by venture capitalists simply for having a great balance sheet and statement of cash flows. While this post could be a tutorial on the principles of accounting, I want to zoom in on a handful of key metrics.

Monthly Revenue Growth

Take the current month’s revenue, subtract last month’s revenue, and then divide by last month’s revenue.

One surprise for me is that this number is used more by founders than venture capitalists. The reason is that it shows proportion without magnitude, and magnitude matters a lot because a startup’s revenue is a major determinant on what the growth rate can be. If you made $20 last month, you need to increase that to $30 to get a 50 percent growth rate. That might be a single customer. But if you have a $10 million per month revenue business, reaching the same growth is significantly more challenging.

While VCs don’t use this metric as heavily as the next one we will discuss, some guideposts are still helpful. A growth rate of 40 percent per month is very good. A growth rate below 40 percent can be considered good if you can convince an investor that additional capital placed in sales and marketing will drive the growth rate higher.

Revenue Run Rate

Take the revenues recognized in the most recent month and multiply by 12.

VCs often talk about the current revenue run rate as well as the projected run rate in 12 months. So they will say something like “The company is currently at a $2 million run rate, but will be $10 million by the end of the year.” These numbers are often preferred, since they solve the magnitude problem.

Furthermore, almost all startups at the early stage are going to have to raise further capital. So when evaluating a startup, VCs are thinking about where the business has to be in 18–24 months when the next fundraise will happen. Getting a sense of the projected revenue run rate allows us to surmise whether series B or C growth investors are likely to be interested in a company. Thus, great performance is a revenue run rate that allows the next fundraise to happen. To get that number, reach out to investors and other founders until you have a good handle on the trajectory needed for your company.

Margins

Gross margin is calculated as total revenue minus the “cost of goods sold” divided by the revenue. Net margin is similar, except we also subtract the total expenses of the business as well (except for taxes and a handful of other accounting line items).

Margins are important because they show the ability of your startup to spend venture capital and get significant return. There are pretty bright guidelines on what your margins should be given an industry. For example, cloud storage and services companies can reach margins in the 90s, SAAS companies and other software businesses tend to be in the 70s, and hardware companies often struggle to get above 40 percent. Again, research your space until you know exactly what this metric should look like for your particular business.

One additional consideration is margin compression. Margins become tighter when competition is greater, so successful businesses must develop defenses against new entrants who might force a company’s margins lower. I personally have seen dozens of startups fail to receive funding because they could not articulate a strategy to avoid margin compression.

Burn Rate and Runway

This is the operating loss per month. To calculate runway, take the amount of available capital and divide by the monthly burn rate to get the number of months until your start-up runs out of cash.

These numbers show the efficiency of a business, the timeline for fundraising, and the need for capital. While startups are often run quite cheaply until their first fundraise, VCs will want to understand how you will increase your expenses to grow the business more quickly with any new infusion of capital. Lest anyone get the wrong impression, most investors expect their entire investment to be spent within 18–30 months. So if you’re asking for a fundraise of $10 million, but your monthly burn rate is $100,000, you must develop a very clear plan on how the burn rate is going to increase, and how that will propel the growth of the business.

User Metrics

Users are the lifeblood of any company, and therefore, VCs assiduously analyze everything about a startup’s users. Some user metrics are well-known, including daily active users (DAUs) and monthly active users (MAUs). I am actually going to skip those and instead will focus on a couple of other metrics that provide keen insight into a startup’s quality.

K-Value

Choose a time frame, such as one week. Take the number of users at the beginning of the week as a base. Now, track all invites that these users make to other people (for example, using an “Invite Your Friends” link). Aggregate the number of new users entering through this channel and then calculate the ratio of new users to old users and add 1. So, if you start with 1,000 users, and they bring on board 200 new users, we have a ratio of .2 + 1 (our base population) and that leads to a k-value of 1.2.

The k-value is a measure of virality, and is borrowed from epidemiological studies of disease progression. This number is exponential, and defines the magnitude of the user growth rate by word of mouth (as opposed to paid acquisition). For social media startups, this is often the only metric that matters (the other is retention).

Thankfully, there are some clear guidelines for performance. A value less than 1 means that the population is dying and will cease to exist. A value of 1 means that the population is stable. A value of 1.2 is strong, and a value of over 1.4 means incredible growth.

If you start with 1,000 users and have a k-value of 1.2 per week, after 30 weeks you will have about 200,000 users. But if you have a k-value of 1.4, you will have more than 17 million users within the same period. Growing at such a speed usually doesn’t last long, since old users are not as likely as new ones to bring additional users to the product (they already invited everyone!). However, some companies like Facebook and Snapchat have exhibited extremely high growth like this for an extended period of time, so it is certainly possible.

Proportion of Mobile Traffic

Take the number of visits from mobile and divide by the total number of visits to your product.

This is a simple ratio, but an important one in a world where more and more of our time is spent on mobile. Nearly every company that targets consumers and talks to an investor today will have to discuss their mobile strategy. Data today shows that people are potentially spending a majority of their computer usage on mobile devices. Engaging such users is crucial today.

Cohort Analysis and Churn

Take all of the users who joined a product in a given time frame (usually a week). Then calculate how many of these users engaged with the product over every successive week. Churn is slightly different and is calculated by taking the number of users who leave and dividing by the number of total users (regardless of start time).

Cohort analysis is a metric by which we see the decay in user engagement. Users leave even the most sticky products for any number of reasons. For instance, small and medium businesses may leave your product because they are shutting down operation. VCs really like to see cohort-analysis tables, because they give us a perspective on when users are leaving the platform.

First-week retention is probably the most immediately interesting number. For social media, 80 percent one-week churn is very high, 40 percent is good, and only 20 percent is phenomenal. For paid products like SaaS, churn and other conversion metrics tend to make more impact here rather than pure cohort analysis. SaaS churn in the low single digits (1–3 percent) is strong.

Seasonality can be an important component to elucidating cohort analysis. Education startups often see their users return at the beginning of the school year as people think through their software choices. Be sure your story includes all facets of your cohort analysis.

User Acquisition and Marketing Metrics

We know that users are important for a business, but they don’t often walk right through the door. Instead, companies have to exert significant resources to get users to sign up and potentially pay for the product they are selling. Thus, these metrics go to the core of a business model and its sustainability.

Cost of Acquiring a Customer and Payback

Take the amount spent on all forms of user acquisition (search engine marketing, content marketing, public relations, etc.) and divide by the number of new users within a given period. Thus, if we spent a total of $100,000 acquiring users, and we have 100 new users, we just paid $1000 per user (fully-blended).

This is the bread-and-butter of almost all subscription companies, but also applies to most other startups. While the fully blended number is interesting, it doesn’t give a venture capitalist a lot of information about the channels that users are joining from. Therefore, we often split this into paid and free channels.

Free acquisition is what it sounds like – someone started using a product without seeing an advertisement, perhaps through word of mouth, or maybe reading about it in the press. In contrast, paid acquisition is generally synonymous with advertising. If you spend $60 on Google AdWords and get one customer, you had a CAC of $60. We often express the number of free versus paid acquisitions as a ratio, since this can show if the growth of the user base is primarily organic.

There are a lot of signposts for CAC, almost all of them dependent on the type of business. In general, the higher the ARPU – average revenue per user – the higher the cost of acquiring a customer can be. In social media, this number needs to be as low as possible (and can be near zero if growth is purely viral). In e-commerce, great CAC prices are around $30–$60 per user. Acquisition prices above that are not uncommon, but they do require more diligence. Prices above $200 are pretty rare in successful online businesses. Then again, financial services often have CACs in the upper hundreds, so, as always, there are exceptions.

Another way to judge whether the CAC is reasonable is to calculate the payback time for a new user. In e-commerce, this is generally measured as the number of orders that need to be purchased to cover the cost of acquiring a customer. If the number of orders is one, that is fantastic – it means the customer is immediately profitable. For advertising-driven and freemium subscription startups, payback times of 3–6 months are good, and anything more than 18 months is likely going to be very hard to swallow.

Net Promoter Score

Run a survey among your customers asking how likely it is that they will recommend (i.e. promote) your product to other people on a 1 to 10 scale. Promoters are those who give an answer of 9 or 10, and detractors are those that respond with a 1 or 2. Calculate the proportion of both groups as a total of the survey population. The net promoter score is the proportion of promoters minus the proportion of detractors. Thus, if 50 percent of your customers are promoters and 10 percent are detractors, your net score is 40.

This is one of my favorite metrics. It shows how satisfied your customers are with your product and your overall experience. NPSs of 50 are considered excellent, and companies like Amazon and Google generally hover around such numbers. However, scores as high as 80 or even 90 are possible. Businesses that inculcate such fervency in its customers are highly valuable, and should raise capital easily.

Sales Metrics

So you want to have a company that has actual, flesh-and-blood customers? If so, then you are going to have to build sales channels to efficiently build revenue. These metrics are helpful ways to judge the success of those efforts.

Magic Number

Take the net growth of subscription revenue over two quarters, multiply by 4, and then divide by the total spend on sales and marketing. So if in Q1 we had $200,000 in subscription revenue, and in Q2 we have $400,000, and we spent $300,000 in sales and marketing in Q1, we would have $400,000-$200,000, which is $200,000 net growth, multiplying by 4, we have $800,000, and dividing by our expenses, we have a ratio of 2.66.

This is arguably the best-named metric here, and a favorite of

Scale Venture Partners, which

popularized it. Essentially what this metric calculates is our return on investment of spending a dollar on sales and marketing. For each dollar we spend, we get the magic number back in additional revenue. A magic number above 1 means that a company has found a way to scale sales and marketing to build sustainable profit growth. A number below 1 isn’t necessarily terrible, but it also means that the company is not scaling as efficiently as other companies.

Basket Size and Order Velocity

The average sales price (ASP) is the price of a typical order. Order velocity is the time it takes for a customer to make a repeat purchase.

For e-commerce businesses, these are among the most important metrics to calculate. ASP often drives the rest of a startup’s fundamentals, and so like run rate, acts as a clustering algorithm to quickly assess a startup’s business model for VCs. A high ASP generally means wealthier customers, fewer repeat purchases, more flexibility on the cost of acquiring a customer, etc. Order velocity also is influenced by ASP.

For instance, Uber is a low ASP, high-velocity e-commerce business, whereas One Kings Lane tends toward a high ASP but low-velocity business. There is no “best” answer regarding these metrics, but generally, the lower the ASP, the higher the velocity of sales needs to be to compensate.

Average Sales Cycle

Take the date that a customer is first contacted, and then the date that they make their first purchase. The difference is the sales cycle. Average across all customers.

Like ASP, the average sales cycle often determines a lot of the fundamentals of a startup’s business, and therefore tells us about how to think about a company rather than its performance. We tend to use average sales cycle for enterprise and subscription sales, whereas we use order velocity for e-commerce and other repeatable purchases. Sales to government and education institutions generally have the longest cycles, possibly two years or even longer. Sales to Fortune 500 businesses are shorter, generally 6–18 months depending on the product (for instance, software is easier to purchase than storage infrastructure). Converting a customer in a freemium model can take 18 months or more, but generally a cycle below one year is good.

Long Term Value

This is the total value of a customer over the life of that customer’s relationship with the company.

This metric is really well-known, so I won’t cover it in-depth. It works hand-in-hand with churn, since the length of the relationship is inversely proportional to the churn. Calculating this value tends to be really hard, and getting to a number that is actually comparable across companies is challenging. VCs often have to substitute more objective metrics like ASP to get to values that are more easily measurable. Nonetheless, this number is crucially important, particularly as a company scales for the long-term.

Market Metrics

Startups are competing for the limited time and resources of customers. Understanding the size of a market and its composition is the final metric analysis, but also a key one, since it determines the potential ceiling in value for a company.

Total Addressable Market

This is the total amount of money spent in a startup’s defined space.

While incredibly important, there is a huge amount of fuzziness in any sort of market analysis. Startups may want to define themselves a certain way, and venture capitalists may have an entirely different market in mind when they analyze a startup.

Generally speaking, markets greater than $1 billion are good, and any market definition that uses the word “trillion” is likely to get a laugh from a venture capitalist. Often, describing the TAM is more an opportunity for a founder to demonstrate an understanding of their startup’s market than it is about actually getting a quantitative figure.

Average Wallet Size

This is a key metric for a lot of businesses, particularly enterprise companies. Average wallet size is the total amount that a single customer can spend in a given period of time for a category of services (i.e. its budget). This metric is important because it gives a sense of the financial capabilities of your customers, and it allows a VC to judge how expensive your product is relative to a customer’s appetite.

This number cuts both ways. Startups that charge a small amount compared to the average wallet size are just as risky as those that charge a very high proportion of the wallet size as their product’s price. You don’t generally want to be insignificant, nor do you want to be so large that you knock out an entire budget.

Conclusion

This essay is a crash course in the metrics used in the quantitative analysis of startups by early-stage investors. As I said before, every investor has their own approach, and every startup is unique. Guidelines here are general, and more specialized information from your specific space is always the most important benchmark by which to judge your startup’s performance.

I would like to leave with one important observation, and that is that one metric tends to drive the curiosity of a venture capitalist more than a complete set of decent ones. An incredible k-value by a social media company, an extremely short sales cycle in the Fortune 500, and an incredibly high net promoter score in e-commerce are just some examples of how a single metric can be the defining story of your company.

Finally, and perhaps most importantly, quantitative metrics are informative about various dimensions of a startup’s performance, but they are not conclusive proof of the worth of a startup. Dazzling products with superb design, strong teams, unique markets, and other areas are just as vital to the success of a business. Outstanding metrics are probably necessary to successfully fundraise (particularly today), but they are not usually sufficient to guarantee an outcome. Great companies are built from greatness, both quantitative and qualitative.

[Images via Shutterstock]

VCs often talk about the current revenue run rate as well as the projected run rate in 12 months. So they will say something like “The company is currently at a $2 million run rate, but will be $10 million by the end of the year.” These numbers are often preferred, since they solve the magnitude problem.

VCs often talk about the current revenue run rate as well as the projected run rate in 12 months. So they will say something like “The company is currently at a $2 million run rate, but will be $10 million by the end of the year.” These numbers are often preferred, since they solve the magnitude problem.

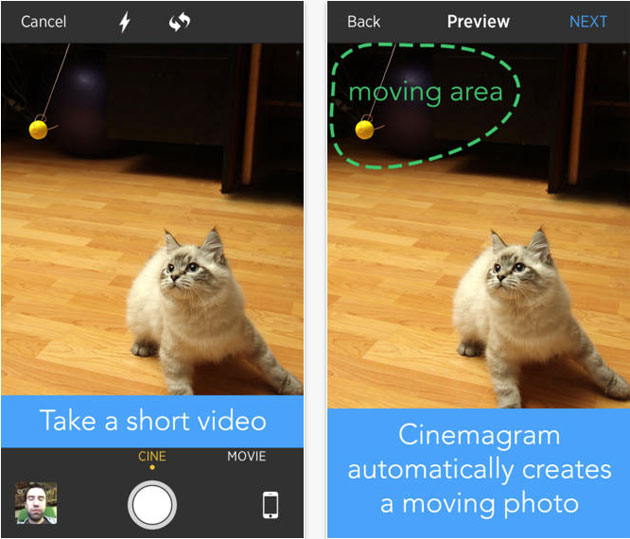

Playing around with Cinemagram's moving photo feature is pretty darn fun, but it comes at a cost: effort. Unlike publishing a Vine or an Instagram video, you need to think about it; what part of this photo do you want to animate? Did you map out the ...

Playing around with Cinemagram's moving photo feature is pretty darn fun, but it comes at a cost: effort. Unlike publishing a Vine or an Instagram video, you need to think about it; what part of this photo do you want to animate? Did you map out the ...

Such sweet, sweet revenge. After the maker of the hugely popular Candy Crush series of games on the App Store somehow managed to trademark the word "candy" in Europe, other developers have started to fight back by blitzing Apple with an ...

Such sweet, sweet revenge. After the maker of the hugely popular Candy Crush series of games on the App Store somehow managed to trademark the word "candy" in Europe, other developers have started to fight back by blitzing Apple with an ...