Global ad spend in 2013 will see steady growth of 3.5% to reach $503 billion by the end of the year, and the amount going into internet advertising will continue to get larger, according to figures out today from Publicis-owned ad agency ZenithOptimedia. In the U.S. — disporportionately the largest single ad market — digital in 2013 will account for 21.8% of all ad spend ($109.7 billion), up from 19% the year before. Meanwhile, mobile remains a solid minority of activity: in the U.S., mobile ads will account for 3.7% of all ad spend ($6.2 billion).

When it comes to what is driving the most growth in advertising at the moment, mobile continues to lead the way, growing by 81% this year in the U.S. market, with that rate slowing down to 61% in 2014 and 53% in 2015, when mobile will make up 8.4% of ad spend. Compare that to Internet advertising, which is growing by around 16% and will account for 27.8% of all U.S. ad spend by 2015.

The figures are no less impressive outside the outsized U.S. market. On a global basis, mobile advertising was worth $8.3bn in 2012, or 9.5% of internet expenditure / 1.7% of advertising across all media. “By 2015 we forecast this total to rise to $33.1 billion, which will be 25.2% of internet expenditure and 6.0% of all expenditure,” the analysts write.

ZenithOptimedia’s analysts say that mobile is growing seven times faster than desktop Internet spend, with mobile ads growing by 77% in 2013, 56% in 2014 and 48% in 2015., driven by the rapid adoption of smartphones and tablets. Globally, internet advertising will grow at an average of 10% a year.

The rapid growth of mobile ads should come as no surprise. On top of the fact that some believe sales of tablets are set to overtake those of PCs by the end of this year, for many consumers in the U.S. — and perhaps even more so in other markets — smartphones are becoming the primary way that they go online. In that regard, this is really just about the sometimes-slow-moving ad industry catching up — not just in terms of media buyers following eyeballs, but (maybe more importantly) the ad tech and publishing industries coming up with more compelling ways of proving that those advertisements are actually making an impact.

ZenithOptimedia does not break out who is leading the charge in mobile ads, although for years now the outsized leader in the space has been Google, which dominates both in mobile search and display ads. However, things are slowly changing and opening up. The acquisition of JumpTap by Millennial Media, Twitter’s acquisition of MoPub, and Facebook’s growing mobile ad revenues are three examples of how we are seeing increasing consolidation of resources, and sharper focus on the mobile ad space.

"After years of hype, mobile advertising has finally arrived. Its importance will only grow over the next few years as advertisers and agencies get to grips with the opportunities it offers, and improve its ability to measure and deliver return on investment," writes Tim Jones, CEO, North America, ZenithOptimedia, in a statement. Yes, I’m pretty sure I’ve read this statement in years past, too; but moves like Twitter’s, and the actual billions in revenue, give some weight to those words at last having some actual meaning.

There is still a long way to go. Although we have all heard about the decline of print and how many old-school publishers are feeling the crunch, and how people are turning off the radio to listen to services like Spotify, the knock-on effect on advertising is taking longer to emerge. If you look at 2012, the combined ad spend for newspapers and magazines still outweighed that of Internet spend. If you add in radio to that, by 2015 they will still outweigh Internet spend.

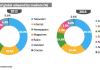

And while we talk about the rise of Internet video and OTT streaming services like Netflix that bypass commercials, television advertising is still by far the biggest piece of the pie — 40% in 2012, and declining by a mere 0.5 percentage points by 2015. That says a lot about why Twitter is focusing so much attention on how it plans to grow its advertising and marketing services in tandem with the TV industry.

ZenithOptimedia focuses largely on what is happening in the U.S. because today and for the next several years, it will remain the biggest market for ad spend. In 2012, there was some $161 billion spent in the U.S. market, which will go up to $182 billion by 2015. The second-closest market is Japan at less than one-third the value and growing more slowly ($52 billion in 2012; $55 billion by 2015).

China and Brazil are the only two emerging markets that cracked the top 10 of top markets last year, but by 2015 it will also include Russia. Among the BRICs, China is the biggest, with some $37 billion in ad spend in 2012, rising to $50 billion in 2015 and almost certainly overtaking Japan the year after, if not sooner.

Meanwhile, in Internet advertising, search continues to be the biggest proportion of revenues, although advances in rich-media technologies and improving broadband speeds and processors on devices are helping display to further narrow the gap between the two, with classified a distant third.

No comments:

Post a Comment